🚀 May 9, Stocks on the U.S. Stock Exchange Soars More Than 100% 3 🚀

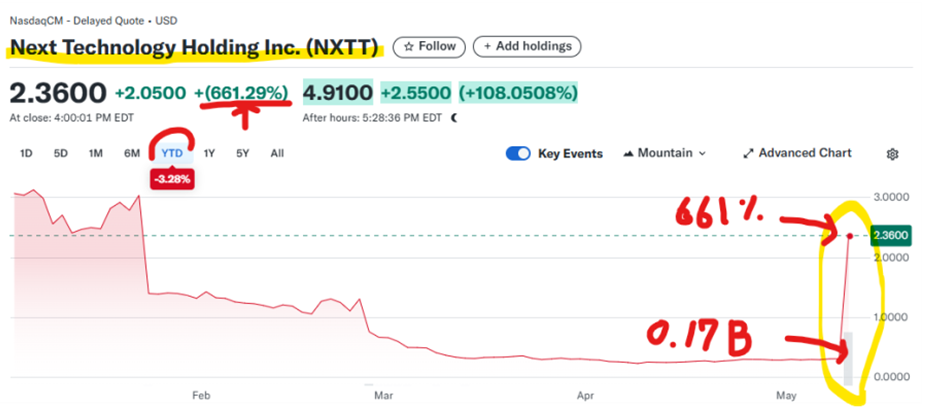

1. Next Technology Holding Inc. (NXTT)

661.29%

2. Abits Group Inc. (ABTS)

262.50%

3. Nuvve Holding Corp. (NVVE)

143.8596%

1. Next Technology Holding Inc

📈 Company Overview

- Year of establishment: 2005

- Headquarters Location: Silicon Valley, California, United States

- Key Business: Acquiring Software Development Services and Bitcoin

- Specialized Areas: Developing AI-Based Software, Holding Bitcoin, and Providing Related Services

- Latest Trends: Stock Surges Due to Increased Bitcoin holdings, Q1 Net Profit Rises On Digital Asset Valuation Profits

- Official website: no information

The company is a China-based company that provides technical services and solutions through its social e-commerce platform.

It provides an international cloud-based intelligence system and has independently developed a microbusiness cloud intelligence system called YCloud.

Through big data analysis, machine learning mechanisms, social network recommendations, and multi-channel data analysis, technology and automated billing management services are provided to microbusiness online stores in China.

📈 the cause of a surge in stock prices

1. Bitcoin holdings increase

- It had around 5,833 Bitcoin as of March 31, 2025, a significant increase from 833 at the end of 2024.

The increase is linked to a large cryptocurrency acquisition in March, which was financed through stock issuance and warrants.

2. Q1 Net Income

- It posted a net profit of approximately $193.4 million in the first quarter due to valuation gains on digital assets.

3. Rise of the Cryptocurrency Market

- Shares of NXTT were also positively impacted as Bitcoin prices rose.

📈 Listed information

|

an exchange

|

Nasdaq Stock Exchange

|

|

a current coin

|

USD

|

|

Settlement date

|

2024-12-31

|

|

Listed date

|

2020-04-08

|

|

Number of shares listed

|

436,265,135

|

|

market capitalization

|

$1,029,585,719

|

📈 Composition of shareholders

| Shareholder's name | Number of shares | specific gravity |

|

Glorious Skyline Ltd

|

1,250,950

|

0.29%

|

|

UBS Financial Services, Inc.

|

32,435

|

0.01%

|

2. Abits Group Inc

📈 Company Overview

- Year of establishment: 1888

- Headquarters location: Abbott Park, Illinois, United States

- Market cap: approximately $180 billion (as of 2025)

- Major business: Medical devices, diagnostic devices, nutritional products, pharmaceuticals, etc

- Specialized Areas: Frestyle Libre for Diabetes Management, Cardiovascular and Neurological Medical Devices, Diagnostic Tests and Nutritional Supplements

- Latest Trends: Medical Devices Segment Revenue Rises In Q1, Announces $500M Investment Plan In U.S

- Official website: https://www.abbott.com

The company is engaged in online and offline business. It operates an online platform and online business for SMEs (SMEs) and provides real stores to communicate with existing/new customers.

It is also engaged in other businesses such as bitcoin mining, digital advertising, insurance, legal proceedings, and crackdowns.

📈 the cause of a surge in stock prices

1. strong first-quarter earnings

- In its first-quarter 2025 earnings report, MedTech's revenue rose 12.5% year-over-year, above market expectations.

2. Expansion of investment in the U.S

- It announced a $500 million investment plan in the U.S., raising expectations for growth potential.

📈 Listed information

|

an exchange

|

Nasdaq Stock Exchange

|

|

a current coin

|

USD

|

|

Settlement date

|

2024-12-31

|

|

Listed date

|

2013-10-28

|

|

Number of shares listed

|

2,370,139

|

|

market capitalization

|

$19,932,869

|

📈 Composition of shareholders

| Shareholder's name | Number of shares | specific gravity |

|

Deng (Conglin)

|

418,741

|

17.67%

|

|

Sun (Danqing)

|

123,467

|

5.21%

|

|

Morgan Stanley & Co. LLC

|

10,000

|

0.42%

|

|

Cutler Group, LP

|

1,330

|

0.06%

|

|

Geode Capital Management, L.L.C.

|

1,042

|

0.04%

|

3. Nuvve Holding Corp

📈 Company Overview

- Year of establishment: 2010

- Headquarters Location: San Diego, California, United States

- Key Business: Providing a Vehicle-to-Grid (V2G) technology platform that enables two-way energy flow between electric vehicles and power grids

- Specialized areas: Energy transactions between EV batteries and power grids, renewable energy integration and power grid stabilization, V2G solutions for electric school buses and commercial vehicles

- Recent Trends: Acquiring Permata Energy Assets, Initiating Investment In Bitcoin, Pushing Financing For EV Charging Infrastructure And Renewable Energy Solutions

- Official website: https://nuvve.com https://nuvve.com

The company is an eco-friendly energy technology company. It provides a commercial V2G (vehicle-to-grid) technology platform that allows electric vehicle (EV) batteries to store unused energy and resell it to local power grids to provide other power grid services.

The company's V2G technology allows multiple EV batteries to be connected to virtual power plants to provide two-way service to the power grid.

The company provides customers with network charging stations, infrastructure, software, professional services, support, monitoring, and parts and labor guarantees needed to operate electric vehicles.

Customers and partners include light vehicles, large vehicles, automakers, charging station operators, and owners/operators of strategic partners.

It also operates a small number of charging stations as part of a pilot project funded by government subsidies.

The platform dynamically manages power between electric vehicles and grids on a large scale.

📈 the cause of a surge in stock prices

1. Permata Energy Acquisition of Assets

- Acquired Permata Energy's assets to strengthen its position in the vehicle-power grid (V2G) market.

2. Entering the Cryptocurrency Business

- It has started its expansion into the digital finance sector with an initial investment in Bitcoin.

3. a financing plan

- Working with Jefferies LLC, we are promoting financing for EV charging infrastructure and renewable energy solutions through the "Electrify New Mexico" initiative.

📈 Listed information

|

an exchange

|

Nasdaq Stock Exchange

|

|

a current coin

|

USD

|

|

Settlement date

|

2024-12-31

|

|

Listed date

|

2020-04-30

|

|

Number of shares listed

|

3,068,049

|

|

market capitalization

|

$8,529,176

|

📈 Composition of shareholders

| Shareholder's name | Number of shares | specific gravity |

|

Bristol Capital Advisors, LLC

|

300,000

|

9.78%

|

|

The Hewlett Fund LP

|

199,478

|

6.50%

|

|

Newton (Charles Carter)

|

121,589

|

3.96%

|

|

Anson Funds Management LP.

|

99,998

|

3.26%

|

|

Rainforest Partners LLC

|

73,840

|

2.41%

|

📌 5/8, ASST's chart soared today